4-18-12 From Seeking Alpha by Phil Davis Read the comments on this article by going directly to the linked source.

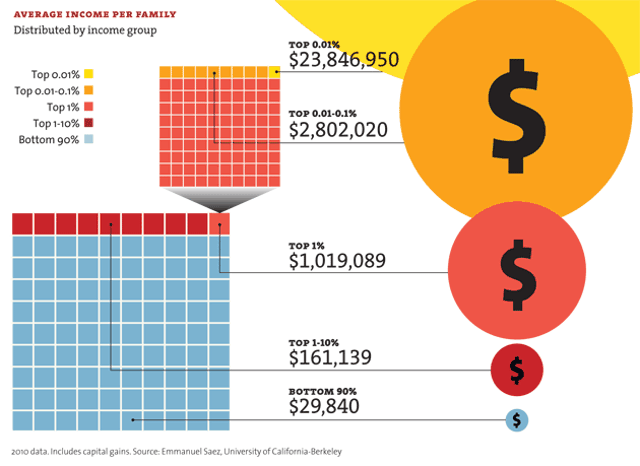

This is an excellent piece about the theft of our economy by the top 10% as of now. The price we 90% are paying now and in the future is dangerous. Romney is all about making sure that the top 10% are kept comfy at the expense of everyone else. It is a major nanny state for the rich. The Fed continues to dole out free cash to the Bankstas even though they are failing to stimulate the real economy--only the financial economy for those playing at the financial market's crap tables.

Read an weep:

See, Cramer is just a great summary of everything that is wrong with investing these days. What a ridiculous over-simplification to act as if the Fed has to say something every day to move the markets - the complete and utter ignorance/disregard of world events is truly stunning on Cramer's show, CNBC and pretty much all of the MSM who won't tell you anything that can't be reduced to a Twitable sound-byte.

See, Cramer is just a great summary of everything that is wrong with investing these days. What a ridiculous over-simplification to act as if the Fed has to say something every day to move the markets - the complete and utter ignorance/disregard of world events is truly stunning on Cramer's show, CNBC and pretty much all of the MSM who won't tell you anything that can't be reduced to a Twitable sound-byte. That's not a healthy-looking divergence, is it? While the bulls are betting that commodities will catch up to the hyper-inflated stock prices, we've been betting the hyper-inflated stock prices will eventually run into the demand reality that is already tanking the commodity markets.

That's not a healthy-looking divergence, is it? While the bulls are betting that commodities will catch up to the hyper-inflated stock prices, we've been betting the hyper-inflated stock prices will eventually run into the demand reality that is already tanking the commodity markets. Aside from the feeding frenzy by our local Banksters at the expense of the Fed, Spanish and Italian banks have used LTRO and EFSF funds to load up on over $600Bn worth of government debt - debt that may well be defaulted on in the same way Greece just did. It's nothing more than a stealth bailout of the top 1% who are cashing in their bonds at top dollar and moving back to cash ahead of the next market collapse.

Aside from the feeding frenzy by our local Banksters at the expense of the Fed, Spanish and Italian banks have used LTRO and EFSF funds to load up on over $600Bn worth of government debt - debt that may well be defaulted on in the same way Greece just did. It's nothing more than a stealth bailout of the top 1% who are cashing in their bonds at top dollar and moving back to cash ahead of the next market collapse. What a scam! A great example of the Dooh Nibor Economy, where the Global Kleptocracycontinues to run policies in their puppet governments that rob from the poor and give to the rich. While French and German banks lost money on Greece's restructuring last month, a delay of more than a year allowed a similar shift of risk to the public sector. When the exchange took place, the debt relief was capped at 59 billion euros because fewer bonds were held by the private sector, including banks outside the country. If Greece had defaulted in 2010, the reduction could have been as much as 232 billion euros.

What a scam! A great example of the Dooh Nibor Economy, where the Global Kleptocracycontinues to run policies in their puppet governments that rob from the poor and give to the rich. While French and German banks lost money on Greece's restructuring last month, a delay of more than a year allowed a similar shift of risk to the public sector. When the exchange took place, the debt relief was capped at 59 billion euros because fewer bonds were held by the private sector, including banks outside the country. If Greece had defaulted in 2010, the reduction could have been as much as 232 billion euros. This is a discussion I have with our conservative friends all the time - it DOES matter where you get your money from. We (the top 1%) are currently extracting our wealth and income from the bottom 99% at a record pace.

This is a discussion I have with our conservative friends all the time - it DOES matter where you get your money from. We (the top 1%) are currently extracting our wealth and income from the bottom 99% at a record pace. According to Romney and the rest of the GOP, it is MUCH more important that we preserve his comfort and his lifestyle than to waste our time helping those who are unable to help themselves. This is the same attitude the Germans are developing regarding their poor European cousins - why should we save you from collapse if it might cause us discomfort?

According to Romney and the rest of the GOP, it is MUCH more important that we preserve his comfort and his lifestyle than to waste our time helping those who are unable to help themselves. This is the same attitude the Germans are developing regarding their poor European cousins - why should we save you from collapse if it might cause us discomfort? Real Americans don't put up with agitators, unless those agitators are from the Tea Party or unless they are anti-tax agitators or unless they want to reduce (not COMPLETELY destroy) our government because, as we all know, government is the problem and private enterprise is the solution!

Real Americans don't put up with agitators, unless those agitators are from the Tea Party or unless they are anti-tax agitators or unless they want to reduce (not COMPLETELY destroy) our government because, as we all know, government is the problem and private enterprise is the solution!

This is an excellent piece about the theft of our economy by the top 10% as of now. The price we 90% are paying now and in the future is dangerous. Romney is all about making sure that the top 10% are kept comfy at the expense of everyone else. It is a major nanny state for the rich. The Fed continues to dole out free cash to the Bankstas even though they are failing to stimulate the real economy--only the financial economy for those playing at the financial market's crap tables.

Read an weep:

Isn't this fun?

On Monday we drew our 50% retracement lines for the Dow (13,000), S&P (1,395), Nasdaq (3,075) NYSE (8,050) and Russell (815) as well as the other global indices that we expected to be tested this week but I cautioned:

"How many times will the bulls be sucked in by the same empty promises? How many times will they reach into their pockets and BUYBUYBUY the snake oil valuations sold by the Reverend James Cramer?"

Now I don't mean to pick on Cramer but it is truly incredible how many times people begin a conversations with me by saying "Cramer says.."Yesterday Cramer said to ignore the experts and their annoying FACTS and just BUYBUYBUY: "No one from the Fed said anything today, yet the market roared, so I imagine these people are stumped beyond belief," Cramer said. "It must be so troubling for them to rationalize this rally."

See, Cramer is just a great summary of everything that is wrong with investing these days. What a ridiculous over-simplification to act as if the Fed has to say something every day to move the markets - the complete and utter ignorance/disregard of world events is truly stunning on Cramer's show, CNBC and pretty much all of the MSM who won't tell you anything that can't be reduced to a Twitable sound-byte.

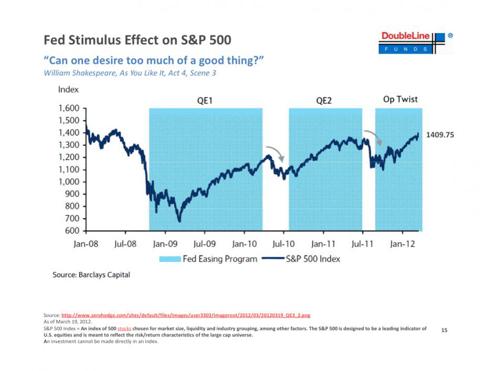

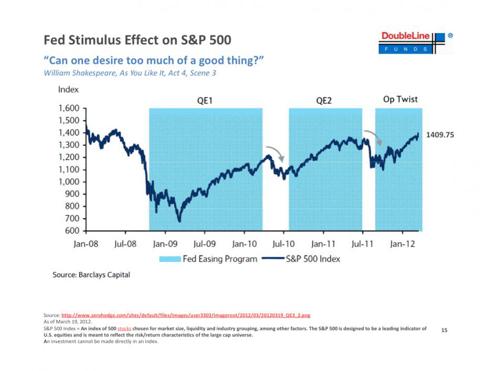

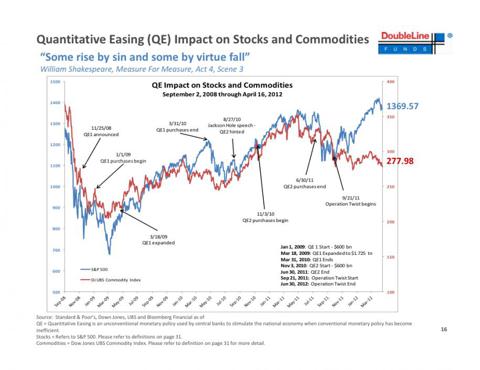

See, Cramer is just a great summary of everything that is wrong with investing these days. What a ridiculous over-simplification to act as if the Fed has to say something every day to move the markets - the complete and utter ignorance/disregard of world events is truly stunning on Cramer's show, CNBC and pretty much all of the MSM who won't tell you anything that can't be reduced to a Twitable sound-byte.On the right, we have the anti-Cramer - a thoughtful presentation by Morningstar's Fixed Asset Manager of the Decade, Jeff Gundlach, who is the only bond fund manager to win the Standard & Poor's/BusinessWeek Excellence in Fund Management five years in a row. I urge you to run through Jeff's presentation as it contains a fantastic series of charts that gives a well-balanced view of the global macros. One very notable chart was this one, showing the divergence between stocks and commodities as Operation Twist has had no stimulative effect on demand:

That's not a healthy-looking divergence, is it? While the bulls are betting that commodities will catch up to the hyper-inflated stock prices, we've been betting the hyper-inflated stock prices will eventually run into the demand reality that is already tanking the commodity markets.

That's not a healthy-looking divergence, is it? While the bulls are betting that commodities will catch up to the hyper-inflated stock prices, we've been betting the hyper-inflated stock prices will eventually run into the demand reality that is already tanking the commodity markets.As we noted in member chat this morning, the central banks are pumping free money into the banks (that will eventually become a burden on the bottom 99% taxpayers and their children and their children's children...), who are not lending it to boost the economies but are turning around (or "twisting") to buy Sovereign Bonds that the top 1% have been stuck with.

Aside from the feeding frenzy by our local Banksters at the expense of the Fed, Spanish and Italian banks have used LTRO and EFSF funds to load up on over $600Bn worth of government debt - debt that may well be defaulted on in the same way Greece just did. It's nothing more than a stealth bailout of the top 1% who are cashing in their bonds at top dollar and moving back to cash ahead of the next market collapse.

Aside from the feeding frenzy by our local Banksters at the expense of the Fed, Spanish and Italian banks have used LTRO and EFSF funds to load up on over $600Bn worth of government debt - debt that may well be defaulted on in the same way Greece just did. It's nothing more than a stealth bailout of the top 1% who are cashing in their bonds at top dollar and moving back to cash ahead of the next market collapse.Even the bankers to Europe's top 1% in Germany and France are CUTTING their holdings in the same bonds by 50% as the bad-debt burden is transferred to the debtor nations, who will later be blamed for making these bad investments as the situation that is clearly visible now will, in the future, be used to justify even harsher austerity measures for their poor neighbors.

"The more banks stop cross-border lending, the more the ECB steps in to do the financing," said Guntram Wolff, deputy director of Bruegel, a Brussels-based research institute. "So the exposure of the core countries to the periphery is shifting from the private to the public sector."

What a scam! A great example of the Dooh Nibor Economy, where the Global Kleptocracycontinues to run policies in their puppet governments that rob from the poor and give to the rich. While French and German banks lost money on Greece's restructuring last month, a delay of more than a year allowed a similar shift of risk to the public sector. When the exchange took place, the debt relief was capped at 59 billion euros because fewer bonds were held by the private sector, including banks outside the country. If Greece had defaulted in 2010, the reduction could have been as much as 232 billion euros.

What a scam! A great example of the Dooh Nibor Economy, where the Global Kleptocracycontinues to run policies in their puppet governments that rob from the poor and give to the rich. While French and German banks lost money on Greece's restructuring last month, a delay of more than a year allowed a similar shift of risk to the public sector. When the exchange took place, the debt relief was capped at 59 billion euros because fewer bonds were held by the private sector, including banks outside the country. If Greece had defaulted in 2010, the reduction could have been as much as 232 billion euros.This amazing global Ponzi scheme is bound to end badly - the only question is when? The bull case (see Cramer) is that the Fed and other Central Baniksters are placing a floor under the market so you "can't lose" - no matter what idiotic valuation you pay for stocks (Gundlach believes 8-10 is the proper P/E for the S&P 500 - now 15). Essentially, people buying the market under this premise are no different than people who invested with Bernie Madoff, knowing it was a scam but not caring as long as they got their 20% returns - it works until it doesn't.

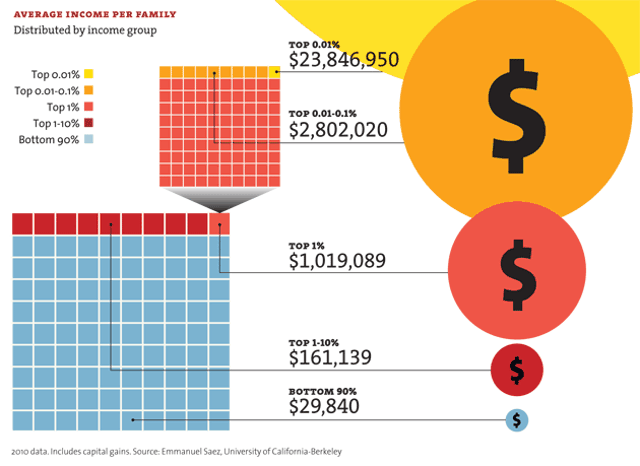

This is a discussion I have with our conservative friends all the time - it DOES matter where you get your money from. We (the top 1%) are currently extracting our wealth and income from the bottom 99% at a record pace.

This is a discussion I have with our conservative friends all the time - it DOES matter where you get your money from. We (the top 1%) are currently extracting our wealth and income from the bottom 99% at a record pace.The gap between the rich and the poor in America has never been wider and AMERICA can't, CANNOT, recover if our survival plan is to get what we can and put it into our 3M lifeboats while letting the other 297M people go down with the ship. The austerity actions being taken now are essentially a justification of theft along the logical lines of "well, those 297M people are going to die anyway so robbing them isn't REALLY a crime, is it?"

The more the corporate media manages to convince the top 10% (no one else matters) that the bottom 90% are unsaveable or "not worth" saving - the more they are able to justify greater and greater abuses heaped upon those down below. Dehumanization of the enemy is an essential part of a propaganda war and make no mistake about it - class warfare is a war and it's not a war that the poor are waging against the rich (despite what their PR machine would have you believe) - it's a war that the rich have been waging against the poor for 40 years now.

This is the way things work people - I apologize for the Michael Moore clip, I know that he is considered to be the great Satan and most of you have been brain-washed to feel sick at the mere mention of his name or the sound of his voice because he ... er ... well, because he did whatever horrible things that you think you know have maybe been insinuated about him by the MSM, right? That's good enough for us because WE'RE REAL AMERICANS, right?

Real Americans don't put up with agitators, unless those agitators are from the Tea Party or unless they are anti-tax agitators or unless they want to reduce (not COMPLETELY destroy) our government because, as we all know, government is the problem and private enterprise is the solution!

Real Americans don't put up with agitators, unless those agitators are from the Tea Party or unless they are anti-tax agitators or unless they want to reduce (not COMPLETELY destroy) our government because, as we all know, government is the problem and private enterprise is the solution!Of course, in this upcoming election we have 242 House Republicans that should be re-elected - it's the 190 Democratic bums that need to be thrown out and THEN you'll see some real action. The Republicans have been hamstrung so far by their 32% advantage in Congressional seats and now we have an historic opportunity to extend the reign of a Congress that only managed to pass 80 laws out of 945 votes taken (with 5,970 resolutions killed on the floor) in 2011 - a record that may only be broken by the same team in 2012 as they are 0 for 89 votes with 627 bills killed in committee in the first quarter of this year - go team!

These people are destroying our country folks. Do you really believe the world's largest economy can afford to do NOTHING for two years? Is this going to be the winning strategy we reward - hamstring a sitting president, let the country run straight downhill and then run for re-election on the premise that, as long as you approve of the guy the people elect to be in charge - you might be willing to play ball. This is not politics - it's extortion!

Let's contemplate that while we wait PATIENTLY for the markets to correct. The point in going over these global and political macros is to get you to step back from the day to day BS that the MSM likes to keep you focused on and contemplate the bigger picture. We discussed many of our recent short plays in yesterday's post and there was no change in yesterday's member chat as we took advantage of that very silly move up to add back some short positions after Monday's profit taking.

Now that we've completed our 50% retrace of the month's drop, we'll be happy to take quick bear losses and go longer if we can accomplish three of five of our 50% lines (see above) but clearly we'll be exercising a HEALTHY degree of skepticism against any short-term market moves.

Early this morning, we took advantage of the morning pop to short the oil futures (/CL) at $104.50 and we're just testing $104 now at 9 a.m. - so the Egg McMuffins are paid for and we're ready to start our trading day!

Kleptocracy by WilliamBanzi7.

(http://eye-on-washington.blogspot.com)

No comments:

Post a Comment