The Fed's Jelly Donut Policy

A Jelly Donut is a yummy mid-afternoon energy boost.

Two Jelly Donuts are an indulgent breakfast.

Three Jelly Donuts may induce a tummy ache.

Six Jelly Donuts -- that's an eating disorder.

Twelve Jelly Donuts is fraternity pledge hazing.

My point is that you can have too much of a good thing and overdoses are destructive. Chairman Bernanke is presently force-feeding us what seems like the 36th Jelly Donut of easy money and wondering why it isn't giving us energy or making us feel better. Instead of a robust recovery, the economy continues to be sluggish. Last year, when asked why his measures weren't working, he suggested it was "bad luck."

I don't think luck has anything to do with it. The blame lies in his misunderstanding of human nature. The textbooks presume that easier money will always result in a stronger economy, but that's a bad assumption. Here is a good example of how a real family responds to monetary policy.

Consider my neighbors, Homer, Marge, and their three adult children, Bart, Lisa and Maggie. Homer has retired from the nuclear plant, and he and Marge live off savings and Homer's pension. Bart is in a bit of trouble with too much credit card debt and an underwater mortgage. Lisa has been putting away her salary and has enough for a downpayment on her first home. Maggie owns her own business and is ready to expand.

When interest rates are high, Homer and Marge park their savings in CDs or Money Market accounts and get a decent return. There is no incentive for them to take much risk with their money. Bart gets into trouble very quickly and defaults on his loans. Lisa decides she can't afford a mortgage until rates fall. And Maggie, who's been helping out Bart with some of his expenses, believes that she'd make money if she grew the business, but possibly not enough to service the debt she'd be undertaking.

When interest rates are low, everything changes. Homer and Marge are getting only a little interest on their savings, and are struggling to live off Homer's pension. They need to rethink their finances. Bart can manage to keep up the minimum payments on his credit cards and stay in his house. Lisa can get a cheap mortgage, and Maggie doesn't need to make such optimistic assumptions in order to expand her business.

Everyone agrees that low interest rates are a good way to stimulate a stalled economy. The Fed takes this logic a step further. It believes that if low interest rates are good, then zero-interest rates must be even better. As a brief emergency measure, such drastic behavior is reasonable and can even be necessary. In 2008, Chairman Bernanke had near unanimous support for his decision to drop rates to near zero. At the peak of the crisis, it made sense. But that was four long years and many jelly donuts ago. In the 2012 economy, a zero rate policy not only adds no benefit, it's actually harmful. Just ask the Simpsons.

When Homer was approaching 65, he and Marge met with a financial planner to figure out if they had enough money saved for retirement. They assumed they'd live to be 90, and could count on receiving a fixed amount from Homer's pension and social security checks. Marge, the cautious one, has not forgotten that stock market meltdown better known as the bursting of the tech bubble. She didn't want to take any investment risk and was content to have just enough for regular haircuts for herself, a bowling and beer budget for Homer, and visits with the children. They were told that, with nominal interest rates at 3%, they could safely retire with $200,000.

"What happens if interest rates go to zero and stay there?" Marge asked the advisor.

"You mean indefinitely? If you weren't willing to start taking investment risk, you'd need 50% more in savings, or $300,000. But why would you ask such a silly question?" asked the advisor.

To which Marge replied, "Well, we were thinking about moving to Japan..."

Homer and Marge aren't the only ones doing this sort of math. Every single day for the next 19 years, more than 10,000 Baby Boomers will turn 65. Those who started saving for retirement 15 years ago are suddenly finding themselves with insufficient savings to do so.

Some will stay in the work force longer, some will drastically reduce their spending, and some will do both. In a recent

survey, 20% of U.S. workers say they have postponed their planned retirement age at least once during the last year. And those who have already retired have fewer options. Returning to the workforce could be challenging. David Rosenberg

points out that the workforce for those 55 and older has expanded by 4 million since the start of the recession, and they are returning to the workforce at lower wages. Even more challenging is trying to find safe investments that generate a decent yield.

Zero-rate policy makes traditional riskless investments, such as CDs and Money Markets, unattractive to savers. Rather than view this as an unfortunate consequence of policy, Chairman Bernanke sees this as a benefit. He subscribes to the philosophy that rising stock prices will contribute to a 'virtuous cycle' of economic growth. He's hoping that those approaching retirement, and even the retired, will abandon the idea of making safe returns, and put their savings into equities instead.

In a similar vein, the Fed believes that by lowering interest rates, it makes bonds unattractive compared to stocks. Using logic worthy of Montgomery Burns, Homer's old boss at the Springfield Nuclear Plant, the Chairman is hoping to create a Wealth Effect. I can almost hear Mr. Burns and his sycophantic aide Smithers now:

Smithers: "Sir, you're saying we need the stock market to go up?"

Burns: "Yes, that's the fix we're looking for."

Smithers: "And why would that be, sir?"

Burns: "Don't you get it? A rising stock market allows people to feel wealthy. And a seemingly wealthy person is a profligate person."

Smithers: "Profligate, sir?"

Burns: "Profligate.

It means they spend money they don't have on things they don't need."

Smithers: "So instead of enabling people to actually have more disposable income, we'll get them to spend more by simply making them feel rich?"

Burns: "Exactly! Now how can we do that?"

Smithers: "Well, we can always encourage them to sell their bonds and buy stocks."

Burns: "Now how would we ever convince them to do something as foolish as that?"

Smithers: "Just set interest rates to zero indefinitely. Then no one can afford not to invest in the market."

Burns: "Why, Smithers, that's brilliant! This is exactly the kind of counter-intuitive thinking we've been needing around here!"

Only it's not counter-intuitive; it is simply misguided thinking that persists among the Fed Chairman and other government ivory tower thinkers. They do not understand or relate to the prime component of capitalism and a free market: greed. And because they do not understand greed, they also do not understand fear, which presents a double whammy for making bad policy decisions.

****

Let's think about it from an investor's perspective: For about 30 years, bonds have mostly risen in value. By directly intervening in the bond market and by promising zero percent short-term interest rates through 2014, the Fed has all but guaranteed that it will do what it takes to keep bond prices from falling. Right now, Homer and Marge own bonds that yield 2%, practically risk-free. What rational investor will sell when there is no downside?

For years, people have talked about the 'Greenspan put' or the 'Bernanke put' on the stock market. Some question whether such a put is deliberate, others question its effectiveness, and some even question whether or not it exists at all. The Fed has always explicitly denied using monetary policy to create a floor on the markets, and its inability to do so should have been settled when the NASDAQ fell 78%. As for whether or not the Fed puts are a myth, I think it depends on where you look.

It isn't where you think: The real Fed put is under the bond market.

If the Fed's hope is to drive investors into equities, propping up the bond market is counter-productive. While there are many parts of the cycle where higher bond prices fuel higher stock prices, at this point in the cycle the relationship has reversed. In recent months, stocks and bonds have developed a strong negative correlation -- what is bad for bonds, is good for stocks. The Fed does not understand investor psychology: If you want to get people to sell bonds and buy stocks, the best way to do that is to show them that bond prices can, and do, fall.

Another flaw in the Fed's logic is that many savers aren't willing to participate in the virtuous cycle experiment. Some might be convinced to take on this risk. But others who, like Marge, have seen the market get cut in half twice in the last dozen years, will resist. They don't believe it is prudent to gamble their nest egg in the market.

Those who have given up on earning more will have to save more and spend less. This is the antithesis of a wealth effect, and their reduced spending is a drag on the economy.

This reduced spending has unintended consequences for the Simpson kids as well. Chairman Bernanke is unwilling to raise rates, even by a modest amount. He's hoping that his zero-rate interest policy will encourage Lisa to buy that house and persuade Maggie to start expanding the business. He worries that a rate hike will discourage them from doing so. What he cannot seem to acknowledge is that it's been three years of ZIRP, yet credit-worthy borrowers still are not looking for loans.

Interest rates are only one consideration when looking to invest. If it makes sense to build a factory in a 2% ten-year note environment, it probably still makes sense to build it with long rates at 4%. Long duration investments of that nature have so many other risks that, once rates are low enough, further reductions in the marginal cost of money no longer make much difference.

The corollary is that if it doesn't make sense at 2%, it isn't going to make sense at 1% or even at zero, because there must be some other reason not to build. The cost of money has long since passed the point where it is a constraint on otherwise sensible economic behavior in the real economy. Incrementally lower rates no longer trigger large refinancing, let alone construction booms, in the mortgage and housing markets.

Putting money back into the hands of savers would stimulate the economy and might be just the push that Maggie needs to go ahead with that business expansion.

Another blob of jelly that we are still working to digest is the Fed's promise to keep rates at zero for a long time. Chairman Bernanke hopes this will encourage borrowing and investment, but it may have the opposite effect because it undermines any sense of urgency. By setting the time value of money to zero, the Fed devalues time.

Retailers know that to create short-term demand for a promoted special, you have to create a reason to Buy Now! -- "One day Bonanza," "First 1,000 customers through the door," and even the softer, "Good while supplies last," incite action. The promise to keep rates low invites procrastination. Why should anyone make a marginal decision to borrow and spend or build today, knowing that low-cost financing will still be available through the end of 2014?

Chairman Bernanke's strategy of bringing Walmart's Every Day Low Pricing to central banking has not worked. If the Fed Chairman wants to light a fire under Lisa and Maggie, announcing a small rate increase with the possibility of more to come could provide the incentive they need to buy or build rather than risk missing out.

****

Some will argue that if the Fed raises rates, it will cause deflation. Just the word 'deflation' makes Chairman Bernanke break into a cold sweat and reach for the Jelly Donuts. Fear of deflation should depend on what, exactly, is deflating.

The sort of deflation that puts pressure on wages is a clear negative, as it leads to a lower standard of living. On the other hand, lower prices caused by scientific progress and higher efficiency are unambiguously positive.

Apple's newest iPhone has twice the memory, a better camera, and other small improvements and carries the same price as the prior version. Government statisticians see an improved product at the same price and count it as a price cut, or deflation.

There is no reason for the Fed to conduct monetary policy to offset advances that improve our standard of living, in particular when it results in driving up the price of something else, like oil.

Yet, while the Fed seems compelled to respond to innovation as if it were a bad thing, it throws up its hands when confronted with rising oil prices. Unfortunately, when the Fed sets policy with a goal of driving prices higher, it doesn't get to choose which prices are most affected.

When asked about the rising oil price, Chairman Bernanke concedes that it is a negative for consumers. He then disclaims any responsibility, and states it is beyond the power of the Fed to affect it. He blames oil prices on emerging markets, political turmoil and speculators. If we take him at his word that speculators are causing the problem, it's worth considering what might be causing the speculation.

From the

2010 Jackson Hole speech that kicked off the QE2 frenzy, spot oil went from $73 to $114 a barrel in eight months. The price of food and most other commodities went up even faster.

While Chairman Bernanke hopes that flooding the market with dollars will get people to buy stocks, he appears less willing to accept that many respond by scrambling for hard assets in fear of dollar debasement. The rush into commodities is further exacerbated by cheap money that enables the inexpensive financing of speculative, levered positions. Again we see the two drivers -- fear and greed -- at work. The consequences of this speculation are reflected in the prices of food and energy.

Worse is that, even if Chairman Bernanke believed his policies were influencing oil prices, it's not clear that it would change his behavior. He seems to believe that inflation is a necessary by-product of growth, and that as long as it is kept under some control, accommodative monetary policy will help the economy.

In the current economic cycle, I do not believe this is true. There is nothing that slows the economy faster than rising oil prices, and most recessions have been preceded by rising or even spiking oil prices. Money spent at the gas pump is not available to be spent at the Kwik-E-Mart on other items.

Inflation has ceased to be an unfortunate by-product of growth. Rather, it is a direct hindrance to growth. We see the evidence in the disappointing growth during the first half of 2011. When the Fed finally signaled that there would be no QE3, commodity inflation stopped, oil prices retreated, and the economy began to improve. Oil prices again rose with the serving of the "Operation Twist" Jelly Donut, putting 2012 growth estimates at risk.

Tighter monetary policy would limit inflation and in all likelihood trigger a pronounced reduction in oil and food prices, which would provide a substantial boost to the real economy. While this thought runs contrary to Fed groupthink, it is consistent with recent experience. In light of this, I cannot understand why we are even discussing, let alone hoping, for QE3.

****

Chairman Bernanke recently gave a series of speeches outlining his view of the role of the Fed and its performance during the financial crisis.

To summarize his version: The crisis wasn't the Fed's fault; the Fed did a heroic job in reacting to the crisis; and the Fed isn't going to repeat perceived mistakes from 80 years ago.

Chairman Bernanke made a number of comments that while historically questionable, reveal his point of view and lend credence to the theory that he has and is likely to continue to under-price the cost of money:

- He points out that to encourage stability central banks are supposed to mitigate financial panics or crises, but pays no similar thought to the idea that they should encourage stability by preventing bubbles.

- He said, "Tightening of monetary policy in 1928 and 1929 to stem stock market speculation" was a "policy error."

- In discussing the causes of the Great Inflation of the 1970s, he said "monetary policymakers responded too slowly" but made no mention of abandoning the gold standard as one of the causes.

- He said that the housing bubble was created by deteriorating underwriting standards and downplays the role of the overly accommodative monetary policy.

Taken together, the message is that when monetary policy proves inadequate, the Bernanke Fed's response has been, and will be, even more aggressive intervention.

So, where are we now? Real GDP is growing between 2-3% and reported inflation is running at between 2 and 3%. Excluding the calculated deflation from technological progress would add about another 1% to inflation. On that basis, nominal growth is probably about 5-7%.

In the face of this, we have a policy of near zero cost money with promises to keep it that way for years, and an open debate as to whether we need more quantitative easing. When this monetary policy is combined with a large fiscal deficit, it leaves policy makers very little flexibility should we enter another recession or encounter another crisis.

I know this isn't conventional thinking, and it certainly isn't the way the Fed looks at it, but I believe that raising short rates -- not to a high level, but to a still low level of 2 or 3% -- would be much more conducive to both growth and stability.

The household sector balance sheet has a negative duration gap, meaning that it holds proportionately more short-term floating assets like bank deposits and money markets compared to its liabilities, which are disproportionately long-term fixed obligations including mortgages.

Raising rates would directly transmit income to families, enabling them to spend more freely and boost the economy -- a stimulus so to speak.

Unfortunately, it appears that Chairman Bernanke is more focused on financial institution balance sheets. While the Fed recently declared most of the largest banks to be healthy, and approved programs to reduce bank capital, continuing with zero rates several years into the recovery reveals a focus to support banks rather than households.

Zero rates allow the banks to carry non-performing and other questionable assets indefinitely. When the cost of money is nearly zero, dead beat borrowers can appear current by making nominal payments. When banks can finance their non-performers for free, they have little incentive to work them out. This lengthening of the work-out process supports banking profits and defers needed pain for some underwater borrowers. But, it also prevents the markets -- particularly the real estate market -- from clearing. This in turn delays the economic recovery and postpones job creation.

Income inequality remains a headline issue. Democrats argue for higher taxes for top earners, and increased transfer payments to those on the other end of the spectrum. Republicans remain opposed to any redistributive policies. Ending the Jelly Donut monetary policy would do more to alleviate income inequality than any of the widely debated changes in the tax code.

For the super wealthy, zero rates supported by a Bernanke put on the bond market encourage outsized income through leveraged speculation. For everyone else, zero rates reduce the standard of living because greater food and energy costs soak up income. Ironically, it is some Republicans that are beginning to question the Jelly Donut monetary policy, while Democrats generally support it. Democrats who sincerely care about income inequality should speak out against the Fed's policies.

It is a reasonable concern that a sudden change in rate policy would be destabilizing to current leveraged investment positions. The market for interest rate derivatives is the largest in the world. Many institutions continue to manage interest rate derivative risk through Value-at-Risk, a flawed concept that I warned about the last time I was here in early 2008. Given the crisis that ensued later that year, and the now-understood meaning of VaR to be 'value of some risks in a normal environment,' it is a remarkable testament to our lack of true reform that the measure is nearly as widely used today as it was then.

As a result, it is important that any policy shift has to be delivered through considered messaging and preparation, as a shift in policy could cause problems for some institutions that are very deeply positioned in the zero-rates-forever camp.

If you haven't exercised in a while, going for that first run is indeed a painful experience. So, yes, policy makers should pay attention to possible disruption, but this is not reason enough to forgo the needed change in rate policy. After jogging for a few days, exercising becomes easier, and as exercising gets easier, the desire for more exercise goes up and the desire for Jelly Donuts goes down.

****

It's time for Chairman Bernanke to begin restoring the markets to their natural balance. Provide the proper incentives for Lisa and Maggie to start investing in the economy again. Let Bart possibly default on his unsustainable debts so that the banks can start getting those loans off the books. Stop giving Mr. Burns access to free money that he can use to speculate in bonds and commodities at the expense of the middle class. As for Homer and Marge, quit trying to fool them into thinking they're wealthy and instead give them the opportunity to retire with some financial security. With a little extra money in their pocket, Marge can go back to the beauty parlor, and Homer can support the beer and bowling economy.

I'd like to turn my attention to the stock market. There are a lot of cheap and even very cheap stocks. The companies in the S&P will earn over $100 per share collectively this year, and the consensus for next year is for higher earnings and no recession. The market is at 14 times earnings and only has to compete with 2% ten-year Treasury notes. Even with the recent rally, equities are cheap enough that they should not need the Fed to push risk-averse savers into stocks or a Bernanke put in order to do well. What gives?

I believe that stocks are depressed because there is a pervasive feeling that something awful is going to happen. What is this enormous tail-risk? It's the intersection of reckless fiscal policy with Jelly Donut monetary policy.

There is a fear that our Fed Chairman is an academic willing to take great systemic risks in an experiment to prove out his thesis as to how we should have fought the last Great Depression.

I believe that removing the tail risk that Chairman Bernanke will feed us a coma inducing dose of Jelly Donuts would go a long way toward restoring the relationship between P/E multiples and long-term interest rates to the benefit of stocks, at the expense of bonds. If the Fed were to stop trying so hard to prop-up the stock market, the reduction in tail risk would probably fuel the market going up on its own.

I think we've reached the point where even Homer can see that the last thing he needs is another Jelly Donut, but the Fed Chairman is oblivious.

We can all say "D'oh!"

****

While I hope that you found this discussion thought-provoking and persuasive, as an investor my job is to figure out what will happen rather than what should happen. If we didn't have a Jelly Donut monetary policy, I would sell gold, sell bonds and buy stocks. But, the Fed is filled with academics who thoughtlessly rely on econometric models that reflexively indicate that repeated Jelly Donut orgies are the best way to get a sugar rush into the economy. And, the Fed Chairman seems to have no trouble rationalizing any policy failure on the basis that "monetary policy cannot be a panacea," or "it's bad luck," or as proof that he just hasn't force fed us enough Jelly Donuts, yet. As long as this is the case, it seems unlikely the Fed will change course.

As a result, I will keep a substantial long exposure to gold -- which serves as a Jelly Donut antidote for my portfolio. While I'd love for our leaders to adopt sensible policies that would reduce the tail risks so that I could sell our gold, one nice thing about gold is that it doesn't even have quarterly conference calls.

David Einhorn is president of Greenlight Capital, Inc., which he co-founded in January 1996. Greenlight Capital is a value-oriented investment advisor whose goal is to achieve high absolute rates of return while minimizing the risk of capital loss. David is also Chairman of the Board of Greenlight Capital Re, Ltd. (NASDAQ:GLRE). He is the author ofFooling Some of the People All of the Time: A Long Short (and Now Complete) Story, published in December 2010.

The Fed Isn't Responsible For Runaway Inequality

Yes, that is what some people are arguing. ZeroHedge, which must be the finest collection of curious economic ideas on the web, published anarticle with this theory, based on another one from Mark Spitznagel that appeared in the WSJ. It isn't so difficult to take the idea apart, so here we go.

The main theories behind their idea:

- Inflationary policies amount to wealth distribution from the poor to the rich because the latter 'get' the new money first

- Or at least because the rich have parked their wealth in assets that "tend to rise disproportionally due to the inflationary policy."

- Middle class incomes started to stagnate and "curiously coincided with the abandonment of the gold exchange standard and the unfettered growth in money and credit that followed on its heels."

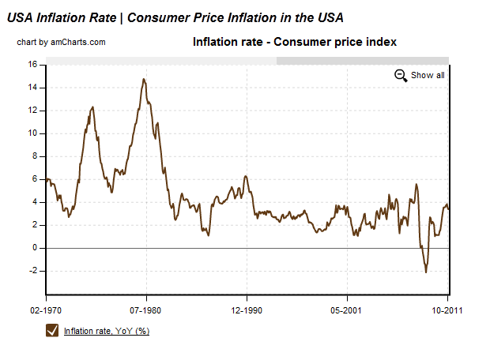

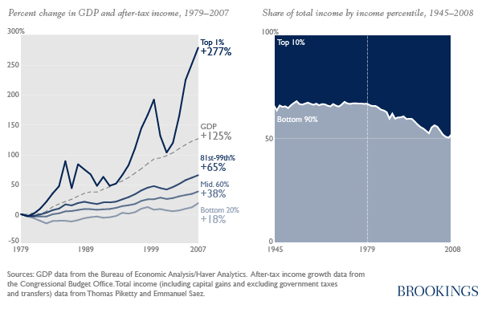

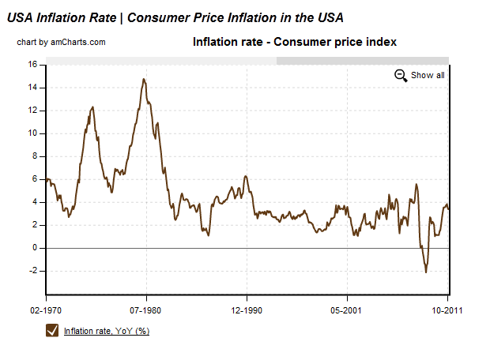

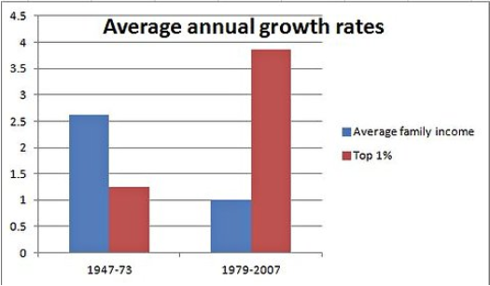

While inflation does have redistributional effects (from lenders to borrowers and from people on nominal income to those that are indexed), to seriously claim that inflation (and therefore the Fed) is responsible for rising inequality and the great stagnation of the US middle classes doesn't pass even the most elementary testing of the data. Let's give you the graph for US inflation first:

(click to enlarge)

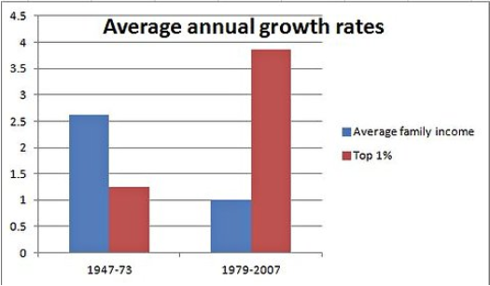

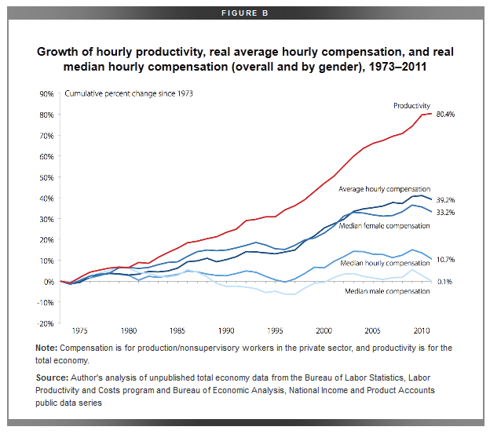

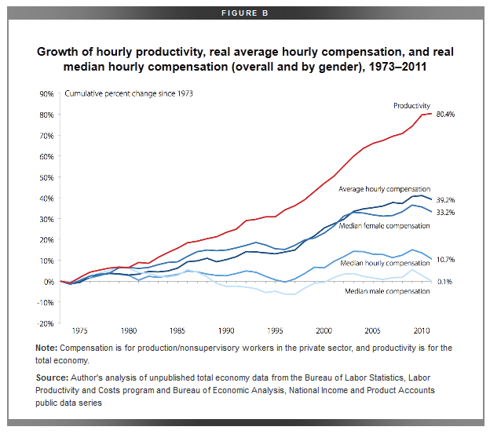

You'll see that the 1970s is the period that had significant inflation, even running at double digits twice for a couple of months. But the actual development of inflation sits very uneasily with the increasing trend in inequality from the 1970s and especially with the stagnation in the median wage.

(click to enlarge)

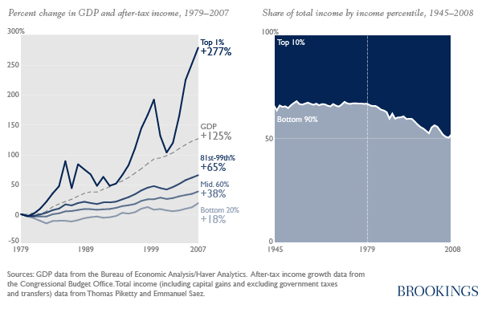

(click to enlarge)

(click to enlarge)

There are numerous empirical observations that directly contradict the thesis that the Fed and inflation is directly responsible for rising inequality:

- Inequality should have risen fastest when inflation was accelerating in the 1970s. This simply didn't happen.

- Inequality should have been reduced when inflation collapsed in the early 1980s (as a result of..the Fed, so much for them being so inflationary) but this didn't happen either.

- Inflation and inequality should have risen in the 1930s when currencies were decoupled from gold, but this didn't happen either.

- In Argentina inflation has been (and is) rampant at 20%+ butinequality was actually significantly reduced, and this after the country came off the currency board with the US dollar which had greatly limited their abilities for monetary expansion.

- Other countries came of the Bretton Woods system at the same time, but the middle class income stagnation is largely a US phenomenon, which is curious, as the US didn't experience the highest inflation of these countries.

- Japan has embarked on bouts of QE, but despite that it suffers from deflation and inequality is low by international standards.

We're sure there is plenty of other empirical data that directly contradicts the thesis that the Fed and inflation are responsible for the rise in inequality.

However, ZeroHedge isn't the only one to relate rising inequality to the financial sector. James Galbraith has done the same, in a new book titled Inequality and Instability, he argues that it is related to the growth of the financial sector:

More specifically, as the financial world has exploded in size across the west, this has made bankers rich, and - equally importantly - pumped up the value of their assets, such as stocks and bonds. [

FT]

While inflation data don't fit the rise in inequality, the growth of the financial sector undoubtedly is an important contributor. The reason for that is technological (electronic trading, etc.) and regulatory, that is, the drive to deregulate the financial sector that enabled it to grow and go wild.

This is by no means the only reason for rising inequality but it is an important one and it fits the facts much better than blaming inflation created by the Fed.

Now, the ZeroHedge article also argues that the Fed "gives money to their friends on Wall Street" (they get it "first," which is why inequality rises).

Krugman has pointed out that this isn't a free lunch; he argued that:

- While Krugman himself is clamoring for more expansionary monetary policy, the financial establishment most definitely isn't.

- Insofar as it involves buying assets at the long maturity (QE), it compresses the yield curve which is bad for banks (which borrow short and lend long).

- The Fed isn't "giving away" money, the banks have to give up assets.

While the litany of disparaging remarks these rather obvious observations seem to provoke is quite remarkable, it cannot hide the fact that these observations are simple truths. On the third point, here is a funny example (again from the ZeroHedge article):

Well, let's look at his voodoo economics claims (how on earth did this guy get a Nobel prize in economics? If ever you needed proof that the prize has become a contrary indicator, Krugman provides it in spades). First of all, you will notice that he fails to mention how exactly the Fed comes into a position to 'buy stuff'. It does that by printing money from thin air, which is actually the central point of Spitznagel's critique. Let's just ignore it!

No, Krugman didn't "ignore it," he merely pointed out that the banks have to give something up, real assets. It's not a free lunch for the banks.

(Go to the link above to read the great comments!!)