3-23-12 by Shareholders Unite from Seeking Alpha

First, we had the supply-side revolution. Basically, this was a movement started with one very reputable economist (Robert Mundell) and a few others, like Jude Wanninski and Arthur Laffer (for a short history, see Bruce Barlett). The basic idea is simple: Tax cuts pay for themselves.

According to Wanninski, each of the main US political parties needed to be a sort of Santa Claus. The Democrats were the spending Santa, but the Republicans should become the tax-cut Santa. The idea was taken up by the influential Irving Kristol and, after spending the 1970s in the political wilderness, it became policy under Ronald Reagan.

Not everybody was immediately taken in. Vice president George Bush famously described it as "voodoo economics," and when he became president he (despite a fair bit of "lip reading"), he raised taxes. But one can say that the idea has renewed currency in the Republican party today (despite the fact that the evidence on its effectiveness isn't terribly encouraging, tax cuts rarely pay for themselves).

However, now the economic forces are such that ideas have been formed pointing to a "demand side" economics going beyond mainstream Keynesianism. The latter (in its policy form) is simply the idea that economic policy should be counter-cyclical, that is, try to stabilize the business cycle. Running budget deficits and lower interest rates when there is a crisis, doing the opposite when there is an economic boom.

But the type of the recession has rendered one type of policy reaction rather impotent (the interest rate reductions) and the other part (increasing public spending) on steroids. To such an extent, in fact, that reputable economist like Larry Summers and Brad DeLong have published a paper in which they argue that under certain economic conditions (which they believe have been met today), increasing public spending can pay for itself.

Yes, you read that correct, this demand side economics is the exact opposite of the supply side economics that swept the Republican party in the 1980s. Is there any more to this idea? We'll have a go at some of the specifics of the Summers-DeLong paper later, first those special economic circumstances, because this idea only has currency due to very special economic circumstances.

Balance sheet recession

The recession we experienced was not an average recession, one in which the economy overheats, inflation takes off, and the Fed has to take away the punch bowl just before the party starts in earnest, raising interest rates to cool things down. No, this recession has been quite a different beast. It was produced by a collapsing asset price bubble, that wiped $9 trillion from households balance sheets but left much of the debt on these.

The recession we experienced was not an average recession, one in which the economy overheats, inflation takes off, and the Fed has to take away the punch bowl just before the party starts in earnest, raising interest rates to cool things down. No, this recession has been quite a different beast. It was produced by a collapsing asset price bubble, that wiped $9 trillion from households balance sheets but left much of the debt on these.

Hence, households, having over-leveraged and seeing a large chunk of their wealth go up in smoke, started to save more, spend less in an effort to de-leverage and repair their balance sheets. Because there were so many households doing this together, the economy got into a serious slump, increasing unemployment and reducing business investment. This reinforced the crisis, a negative spiral was emerging and could only slowed down by some drastic government and Fed action.

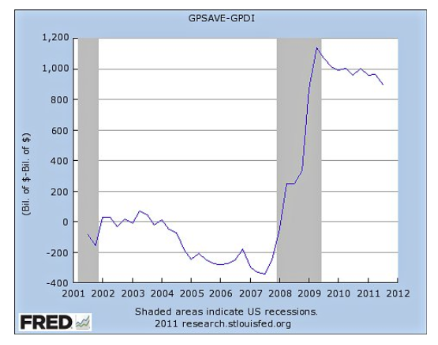

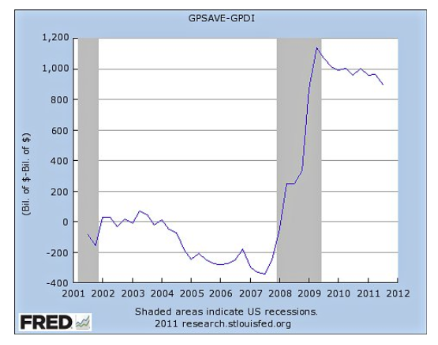

Now, during such a balance sheet recession, the crux is that there is a savings glut. Households are saving more (to repair balance sheets), and business invests less (why invest when capacity utilization and demand are low?)

The result of this oversupply of loanable funds is a sharp drop in interest rates (compounded by the fact that it is a near world-wide phenomenon and central bank policies). Basically this produced a situation that Keynesians are (theoretically) familiar with, the liquidity trap. This is a situation in which only negative interest rates can equate the demand and supply of loanable funds.

In such a situation, monetary policy loses much of its traction (Keynes himself spoke of "pushing on a string"). Other stuff can be (and is) tried, like quantitative easing, but the jury is still out about whether this has much, or even any, effect.

However, the savings glut and super low interest rates put fiscal policy on steroids. The government can borrow at just over 2% for 10 years (interest rates creeping up a bit as a result of the improving economy), and a substantial amount of slack (spare capacity, unemployed workers) produce a situation in which there isn't any danger that public spending will 'crowd out' private spending.

Public spending paying for itself?

So extraordinary is this situation that Summers and DeLong arguing that increasing public expenditures will pay for themselves. Seeking Alpha is not the forum to discuss academic papers in depth, but we'll briefly review the main ingredients while stressing that the conclusions only hold under very exceptional circumstances.

So extraordinary is this situation that Summers and DeLong arguing that increasing public expenditures will pay for themselves. Seeking Alpha is not the forum to discuss academic papers in depth, but we'll briefly review the main ingredients while stressing that the conclusions only hold under very exceptional circumstances.

Under normal circumstances, increasing public spending doesn't pay for itself and monetary policy is usually effective. What are these special circumstances? A few of these have already been mentioned:

- Balance sheet recession creating a savings glut and super low interest rates, making monetary policy ineffective

- A large amount of spare capacity and excess saving making it extremely unlikely that increases in public spending will crowd out any private spending

- The longer the economy functions way below capacity, the more damage is done to that capacity. Plants cannot operate way below capacity for long, so some of them will close, decreasing the potential output the economy is able to produce in the process. Part of labor, if unemployed for too long, loses skills, hope, work attitudes and the like, and risking being discriminated against in the hiring process when the economy finally picks up again.

Since the first two point have already been discussed, the third point is worth pondering, it's known to economist as hysteresis, the phenomenon that short-term change can do long-term damage. One of the main idea of the Summers DeLong paper is that increased public spending keeps resources busy which would otherwise be unemployed.

And if more than 5% of those unemployed resources decay (that is, become effectively unavailable for future production) a year, increased public spending would pay for itself. Summers and DeLong argue that this is the case. Increasing public spending would not only reduce this decaying, or hysteresis effect, it would also boost growth and tax receipts (the mechanism traditional Keynesians focus on). Together, these positive effects would suffice to make increased spending pay for itself.

Evidence

So far, the theory: The strong conclusions of the Summers DeLong paper depend on a specific set of assumptions that no doubt will be discussed in the academic journals for some time to come. However, there are already quite strong indications that increased public spending has positive effects, at least under the present circumstances.

So far, the theory: The strong conclusions of the Summers DeLong paper depend on a specific set of assumptions that no doubt will be discussed in the academic journals for some time to come. However, there are already quite strong indications that increased public spending has positive effects, at least under the present circumstances.

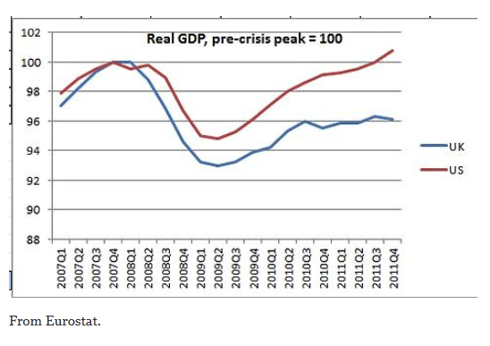

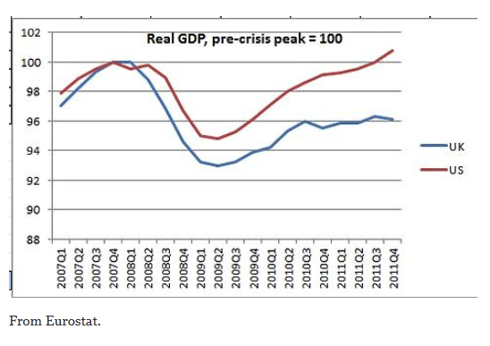

Keynesians like Paul Krugman produce an almost daily barrage of studies portraying the downside of austerity and statistics in which they compare countries that have embarked on austerity (much of the eurozone, Britain), versus countries that haven't, or have done so with a great deal less zeal (the US). Here, for instance, is his figure comparing the UK (austerity) with the US:

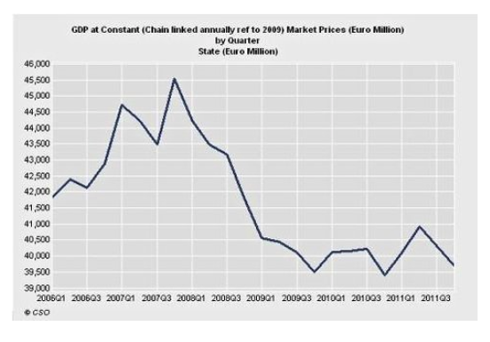

Or, the poster child of the austerity people, Ireland, where that is supposed to have lead to an economic recovery:

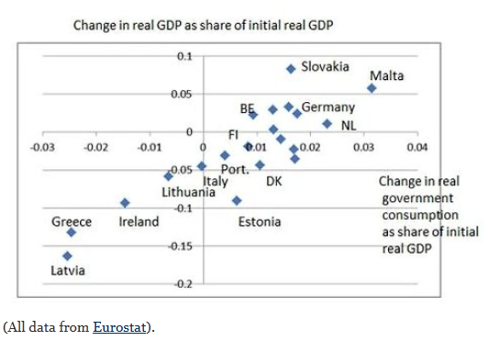

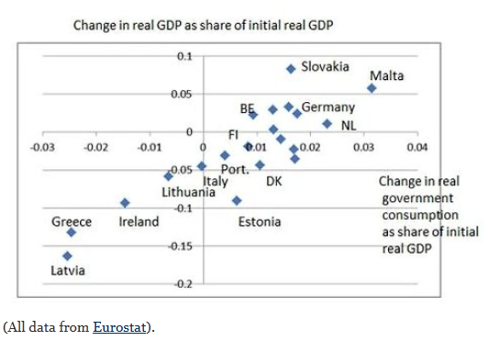

In general, there seems to be a positive relation between public spending and GDP under the present conditions:

It is somewhat surprising that much of the evidence doesn't seem to have been taken on board by policy makers. In fact, those arguing for more fiscal expansion seem, after a brief day in the sun in 2008-9, in retreat, at least in the policy arena. The Krugman insurgency seems well and truly over. This is somewhat unfortunate as the evidence really is on his side.

We have discussed the idea of expansionary austerity, basically the belief that cutting back public spending would automatically be more than compensated by a private sector revival. Under balance sheet recession conditions where interest rates are extremely low, there is no reason to believe this will be happening and no evidence in support.

The only case where this could be said to have happened was the case of Ireland in the late 1980s, were public austerity led to such a drop in interest rates (which were very high at the time) and the currency that they crowded in private spending and the economy was better off.

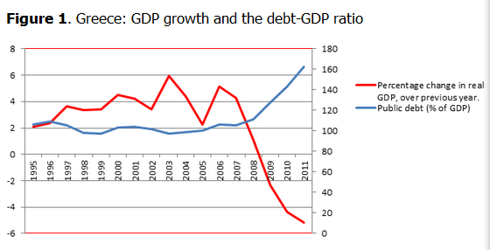

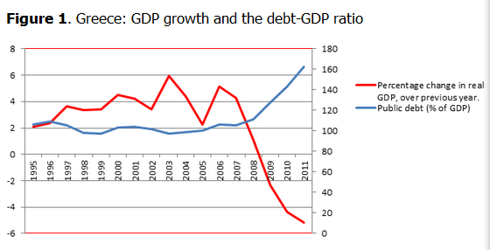

What we do see under balance sheet recession conditions, and especially under fixed exchange rates like the Euro system, is that austerity might be self-defeating even in the limited sense of its effect on public finances, that is, embarking on it worsens the economy so much that public debt levels only deteriorate, leading to more austerity and a sort of vicious cycle. Greece remains a prime example:

But also Italy, embarking on a whopping 3% of GDP austerity program, is experiencing strong negative growth and increases in public debt/GDP ratio as a result.

Conclusion

The present economic conditions where households (and banks) are absorbing the effects of the implosion of a large asset bubble which has impaired their balance sheets is a peculiar one in which the economy behaves differently than under normal conditions. Interest rates fall to record lows despite alarming public sector finances and as a result, monetary policy loses much of its traction.

The present economic conditions where households (and banks) are absorbing the effects of the implosion of a large asset bubble which has impaired their balance sheets is a peculiar one in which the economy behaves differently than under normal conditions. Interest rates fall to record lows despite alarming public sector finances and as a result, monetary policy loses much of its traction.

However, these same conditions increase the effectiveness of fiscal policy, witness the disappointing outcomes of austerity experiments. It could, under certain conditions, even be argued that a fiscal stimulus could pay for itself.

No comments:

Post a Comment