Here is a great piece from Seekingalpha.com written on 8-15-11 by Phil Davis:

Overall, those top 0.7% of taxpayers made over $1.6 TRILLION in income in 2008 (much more this year) and paid $344B in taxes (as 21.5% rate). Raising their rate to 35% would net the government another $216B so, to some extent, Joe is right, it wouldn’t "fix the deficit" all by itself, but raising the top marginal rate back to 70% for people earning more than $10M a year would add ANOTHER $300B, and then we’d be getting somewhere!

Overall, those top 0.7% of taxpayers made over $1.6 TRILLION in income in 2008 (much more this year) and paid $344B in taxes (as 21.5% rate). Raising their rate to 35% would net the government another $216B so, to some extent, Joe is right, it wouldn’t "fix the deficit" all by itself, but raising the top marginal rate back to 70% for people earning more than $10M a year would add ANOTHER $300B, and then we’d be getting somewhere! Buffett said the notion that high taxes discourage hiring and investment is false: "I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9% in 1976-'77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off,” he said. “And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.”

Buffett said the notion that high taxes discourage hiring and investment is false: "I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9% in 1976-'77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off,” he said. “And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.”

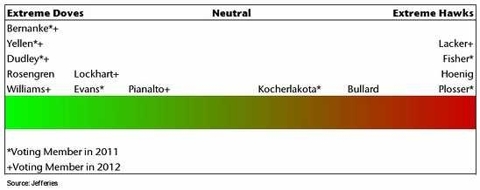

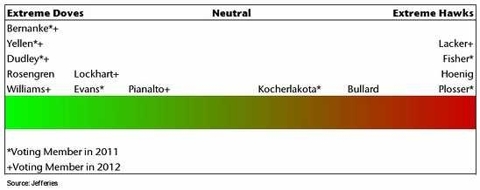

Dudley is, of course, the Fed’s Super-Dove and Lockhart is no slouch when it comes to handing out cash to Banksters either while Fisher can be very conservative, which is probably why they buried him in the middle of the week while Dudley is scheduled to talk over Unemployment Claims at 8:35 on Wednesday and I hope he has a bullhorn because we’re also getting the CPI, Consumer Comfort, Existing Home Sales, Leading Economic Indicators and the Philly Fed that morning so, if there’s a chance for market mayhem this week – Thursday morning will be a good one!

(http://eye-on-washington.blogspot.com)

Warren Buffett paid $6.9M in taxes last year.

While that sounds like a lot of money, it was only 17.4% of his income, about half as much as the average person who works for him paid, and Buffett - unlike most people at the top - believes that is not fair. In his plainly worded New York Times editorial, "Stop Coddling the Super Rich," the $47 billion businessman states:

My friends and I have been coddled long enough by a billionaire-friendly Congress. It’s time for our government to get serious about shared sacrifice.While the poor and middle class fight for us in Afghanistan, and while most Americans struggle to make ends meet, we mega-rich continue to get our extraordinary tax breaks. Some of us are investment managers who earn billions from our daily labors but are allowed to classify our income as “carried interest,” thereby getting a bargain 15 percent tax rate. Others own stock index futures for 10 minutes and have 60 percent of their gain taxed at 15 percent, as if they’d been long-term investors.These and other blessings are showered upon us by legislators in Washington who feel compelled to protect us, much as if we were spotted owls or some other endangered species. It’s nice to have friends in high places.

Of course this caused Joe Kernan and the Conservative Goon Squad on CNBC to pop a blood vessel this morning, making the usual ridiculous statements like ,"Why doesn’t he just send more money?" and my new favorite: "Even if you did tax the top 1%, it wouldn’t be enough money to balance the budget." As noted by Bloomberg, there were 236,883 US households making more than $1M a year in income in 2009, with the bottom 400 making barely $1M a year (I know, how can they afford to pay the help?) and the top 400 taking in (drumroll please…) $91,000,000,000 or an average of $227,000,000 per household.

Overall, those top 0.7% of taxpayers made over $1.6 TRILLION in income in 2008 (much more this year) and paid $344B in taxes (as 21.5% rate). Raising their rate to 35% would net the government another $216B so, to some extent, Joe is right, it wouldn’t "fix the deficit" all by itself, but raising the top marginal rate back to 70% for people earning more than $10M a year would add ANOTHER $300B, and then we’d be getting somewhere!

Overall, those top 0.7% of taxpayers made over $1.6 TRILLION in income in 2008 (much more this year) and paid $344B in taxes (as 21.5% rate). Raising their rate to 35% would net the government another $216B so, to some extent, Joe is right, it wouldn’t "fix the deficit" all by itself, but raising the top marginal rate back to 70% for people earning more than $10M a year would add ANOTHER $300B, and then we’d be getting somewhere!That would only leave our 236,883 "job creators" with $700,000,000,000 or about $3M a year each after taxes – hardly seems worth getting out of bed for, does it? On the other hand, maybe they’d be motivated to MAKE more money – how about we do give them an incentive of 20% of the taxes paid by every job they actually create? Let THAT be their incentive under our tax structure, rather than which foreign country or shell corporation is best to hide the money in. That way, a small businessman who employs 20 new people at wages that allow them to pay $200,000 in taxes, takes home an extra $40,000 as a thank-you from Uncle Sam – how’s that for the RIGHT kind of motivation?

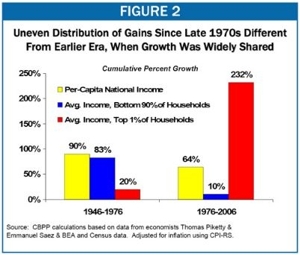

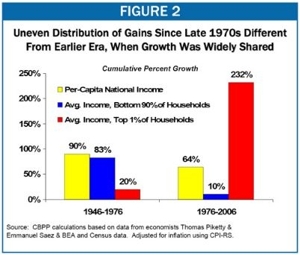

Buffett said the notion that high taxes discourage hiring and investment is false: "I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9% in 1976-'77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off,” he said. “And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.”

Buffett said the notion that high taxes discourage hiring and investment is false: "I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9% in 1976-'77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off,” he said. “And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.”It would take many years of what the wealthy would consider harsh tax policies to just begin to unwind the decades of abuse that has left our country’s finances in such a sorry state. It’s a very easy problem to fix, though – this county has a collection problem, not a spending one and, as I mentioned in my weekend post "Problem Solving 101 – Republicans" – all it takes is the election of some responsible adults and we can begin to address, not just individual taxation but the much, Much, MUCH broader issue of corporate taxation – which is a total joke!

That, however, will be the topic of next weekend’s post. Now, we need to figure out if the markets will go up or down 10% this week!

Very little happened this weekend, and that’s not really a good thing. With the entire global economy on the verge of collapse – it would have been kind of nice if SOMETHING were being done about it, don’t you think? In Europe, there is talk of creating a "Euro Bond," which seems to be a way of putting everything off into one MASSIVE default down the road, rather than having a series of defaults this decade. The US already has a similar program in place – it’s called T Bills!My gal Michele Bachmann kicked butt in Iowa last week with 28.5% of the vote, and her wacky uncle Ron Paul came in second with 27.6% of the vote, completely embarrassing Tim Pawlenty, who came in third with just 13.5% of the vote, despite outspending his rivals 2:1.

The straw-poll scene was as much a carnival as it was a political contest. National polls may indicate that the tea-party tide is ebbing, especially in the wake of the showdown in Washington over raising the nation’s statutory borrowing limit. But the tri-cornered hats and Don’t Tread on Me flags of the tea-party activists who powered Republican victories last November were out in force. Mr. Santorum showed up with a bagpiper leading the way. Mr. Paul built Paul’s Prosperity Playground, complete with "The Sliding Dollar" kids’ slide and an "End the Fed" dunk tank. Mrs. Bachman’s camp was particularly aggressive in seeking votes. A Bachmann aide, speaking over a loudspeaker, warned the throng outside her enclosed tent that no one would be allowed in to see the Randy Travis concert unless they had already voted.

A dollar slide is just what we need to pop the markets back over our "must hold" lines of Dow 11,590, S&P 1,235, Nasdaq 2,603, NYSE 7,866 and Russell 735 (-5% on the now-lagging RUT- see Stock World Weekly for updated big chart and weekly data preview). Not a lot to ask for for the week but the Dollar is already down below 74.50 so it’s going to be up to the EU to build confidence in their Frankenconomy while the Bank of Japan needs to stop trying to dump the yen by boosting the buck. Of course, if there’s anyone who can get people to completely lose confidence in US Currency – it’s the Federal Reserve and we’ll be hearing 5 speeches from 4 governors this week, beginning with Lockhart at 1:25 this afternoon then Fisher on Wednesday, Dudley on Thursday and Dudley again on Friday morning along with Pianalto in the afternoon.

Dudley is, of course, the Fed’s Super-Dove and Lockhart is no slouch when it comes to handing out cash to Banksters either while Fisher can be very conservative, which is probably why they buried him in the middle of the week while Dudley is scheduled to talk over Unemployment Claims at 8:35 on Wednesday and I hope he has a bullhorn because we’re also getting the CPI, Consumer Comfort, Existing Home Sales, Leading Economic Indicators and the Philly Fed that morning so, if there’s a chance for market mayhem this week – Thursday morning will be a good one!

Japan’s (the world’s 3rd largest economy) GDP "only" shrank 0.3%, which is tied with France, who didn’t have the excuse of an earthquake and a nuclear meltdown to give to the teacher so that is very encouraging. After viewing this data and realizing how poorly their top partner in the Eurozone is faring, Germany is no longer ruling out invading aiding France, through a bomb bond program. Yes, everything old is new again…

The BOE is doing all they can to trash their currency with another round of Quantitative Easing. Dhaval Joshi of BCA Research argues the policy of creating money to lift asset prices and bank earnings is a perverse attempt at trickle-down economics that only exacerbates income inequality – maybe not the cause, but surely a factor in the recent rioting.

Meanwhile, The tiny town of Moratalla is the first to admit what faces many of Spain’s municipalities – it is essentially broke from debts and obligations run up during the credit boom. In the much larger region of Castilla la Mancha, pharmacies are striking over the government’s non-payment of bills for prescription drugs. "There is no machine to make money," laments a mayor.

No machine to make money? Obviously, this guy has never met our Fed chairman…

Let the games begin!

No comments:

Post a Comment